Indefinite sum: Difference between revisions

en>Yobot m WP:CHECKWIKI errors fixed + general fixes using AWB (8961) |

|||

| Line 1: | Line 1: | ||

{{economics sidebar}} | |||

A '''rare disaster''' is an economic event that is infrequent and large in magnitude, having a negative effect on an economy. Rare disasters are important because they provide an explanation of the [[equity premium puzzle]], the behavior of [[interest rates]], and other economic phenomena. | |||

The parameters for a rare disaster are a substantial drop in [[GDP]] and at least a 10% decrease in [[Consumption (economics)|consumption]]. Examples include financial disasters: [[The Great Depression]] and the [[Asian Financial Crisis]]; wars: [[World War I]], [[World War II]] and regional conflicts; epidemics: Influenza outbreaks and the Asian Flu; and weather events: Tsunamis and Earthquakes; however, any event that has a substantial impact on GDP and consumption could be considered a rare disaster. | |||

The idea was first proposed by [[Rietz]] in 1988, as a way to explain the equity premium puzzle. Since then, other economists have added to and strengthened the idea with evidence, but many economists are still skeptical of the theory. | |||

==Model== | |||

The model set forth by [[Robert Barro|Barro]] is based upon the Lucas's fruit tree model of asset pricing with exogenous, stochastic production. The economy is closed, the amount of trees is fixed, output equals consumption ( {{math|<VAR>A</VAR> <sub>''t'' + 1</sub> {{=}} <VAR>C</VAR> <sub>''t''</sub>}} ) and there is no investment or depreciation. As ( {{math|<VAR>A</VAR> <sub>''t'' + 1</sub>}} ) is the output of all the trees in the economy and ( <math>{P_t}</math> ) is the price of the periods fruit (the equity claim). The equation below shows the gross return on the fruit tree in one period.<ref name= "Barro10">{{cite web|last=Barro|first=Robert|title= Rare Disasters and Asset Markets in the Twentieth Century|url=http://www.economics.harvard.edu/faculty/barro/files/equity%20premium%2012-1-05.pdf|publisher=The | |||

Quarterly Journal of Economics|pages =10–20.|work=|accessdate=2009-03-09}}</ref> | |||

:<math>R=\frac{A_{t+1}}{P_{t1}}</math> | |||

In order to model rare disasters, Barro introduces the equation below, which is a stochastic process for aggregate output growth. In the model, there are three types of economic shocks: | |||

a.) Normal [[iid]] shocks<br> | |||

b.) Type (<math>\tilde{w}_{t+1}</math>) disasters which involve sharp contractions in output, but no default on debt.<br> | |||

c.) Type (<math>\tilde{v}</math>) disasters which involve sharp contractions in output and at least a partial default on debt. | |||

:<math>\log A_{t+1} = \log A_t + \bar{g} + \tilde{u}_{t+1}+\tilde{v}_{t+1}</math> | |||

The type ω (<math>\tilde{v}_{t+1}</math>) models low probability disasters and (<math>\tilde{u}_{t+1}</math>) is a random iid variable. They are assumed to be independent so they are interchangeable in the equation. Then from the above equation, the magnitude of the contraction from (<math>\tilde{v}_{t+1}</math>) is determined by the following equation. | |||

:<math>\begin{cases} | |||

1 & (e^{-p})\mbox{ no disaster} \\ | |||

1-b & (1-e^{-p})\mbox{ disaster} \\ | |||

\end{cases}</math> | |||

In this equation, p is the probability per unit of time that a disaster will occur in each period. If the disaster occurs, b is the factor by which consumption will shrink. The model requires a p that is small and a b that large to correctly model rare disasters. In Barro's analysis, d is also used to deal with the problem of the partial default on bonds. | |||

==Applications== | |||

Since Rietz and Barro, the rare disaster framework can be used to explain many events in finance and economics. | |||

===The Equity Premium=== | |||

Much of the [[equity premium puzzle]] can be explained by the rare disaster scenarios proposed by Barro and Rietz. The basic reasoning is that if people are aware that rare disasters (i.e. the Great Depression or World War I and World War II) may occur, but the disaster never occurs during their lives, then the equity premium will appear high. | |||

Barro and subsequent economists have provided historical evidence to support this claim. Using this evidence, Barro shows that rare disasters occur frequently and in large magnitude, in economies around the world from a period from the mid-19th century to the present day. | |||

Further, the evidence shows that in the long run the risk premium is around 5.0% in most countries. However, if when looking at specific periods of time this premium may be higher or lower. For example, if a data set of the period of the Great Depression is observed, then the equity premium will be about 0.4%, because the Great Depression was a rare disaster.<ref name="Barro10"/> | |||

===Risk-Free Interest Rate Behavior=== | |||

[[File:riskfree.png|260px|right|thumb]] | |||

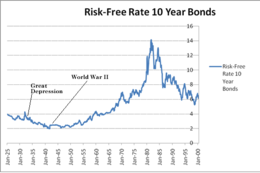

The [[risk-free interest rate]] (the interest received on fixed income, like bonds) may also be explained by rare disasters. Using data in the United States, the rare disaster model shows that the risk-free rate falls by a large margin (from .127 to .035) when a rare disaster with the probability of .017 is introduced into the data set.<ref name="Barro10" /> | |||

Furthermore, Barro defends the criticisms about the behavior of the risk free rate raised by Mehra with respect to the Great Depression and events such as dropping the Atom Bomb in World War II. He reasons that two effects go into people's expectation of rare disasters-the probability of a rare disaster and the [[probability of default]]. In an event that has the possibility of nuclear war (like the Cuban Missile Crisis or World War II), the probability of a disaster would rise and therefore, decrease interest rates. However, the probability of government default on bonds also increases, because of the possible destruction of countries, which raises the rate on bonds. These to forces counteract and lead to ambiguity. As shown left with the risk free rate before and falling after the Great Depression, then falling initially during World War II and then rising afterward.<ref name="Barro10"/> | |||

==History== | |||

[[Edward C. Prescott]] and [[Rajnish Mehra]] first proposed the Equity Premium Puzzle in 1985. In 1988, Rietz suggested that large and infrequent economic shocks could explain the equity premium (the premium of securities over fixed income assets). However, it was not deemed feasible at the time, because it seemed that such events were too rare and could not occur in reality.<ref name="Mehra10">pp. 2–3</ref> The theory was forgotten until 2005, when [[Robert Barro]] provided evidence of nations from around the world from the 19th and 20th century, showing that these events were possible and have happened. Since his papers, others have submitted different ideas regarding rare disasters' impact on other economic phenomenon.<ref name="Mehra10">pp. 4–11</ref> However, many economists remain skeptical of how much rare disasters really explain the equity premium and Mehra still expresses doubt as to the validity of the theory.<ref name="MehraHist">* {{cite web|author=Ranjish Mehra|title=The Equity Premium Puzzle: A Review|url=http://www.academicwebpages.com/preview/mehra/pdf/FIN%200201.pdf|publisher=Foundations and Trends in Finance: 2008 Vol. 2: No 1, pp 1–81.|work=|accessdate=2009-03-09}}</ref> | |||

==Controversy== | |||

Rajnish Mehra was skeptical of Reitz's claim that rare disasters explain the equity premium and real interest rate behavior, because the rare disaster that Rietz had specified had never occurred in the U.S. Rietz suggested 25-97% drops, but this has never happened in the United States. Even if this were true, there are several other flaws regarding his model, parameters, | |||

and supporting evidence. The model Rietz presented did not compensate for a partial default on bond holders do due | |||

rapid inflation. Further, the risk aversion in parameter was used inconsistently in his analysis. For example, a | |||

value of 10 was used to show a 25% drop in consumption, but a value of 1 is used to explain stock returns and | |||

consumption. Finally, more historical evidence was said to have been needed to give the theory proper support. For | |||

example, the perceived probability of a rare disaster should have been low before the atomic bomb was dropped and | |||

must have been higher before the [[Cuban Missile Crisis]] than after. Therefore, real interest rates should have | |||

correlated with these events, but they did not. Mehra concluded that Rietz's scenario was far too extreme to | |||

resolve the puzzle.<ref name="MehraHist"/> | |||

==References== | |||

===Notes=== | |||

{{reflist|2}} | |||

===Bibliography=== | |||

* {{cite web|author=Ranjnish Mehra(2003)|title=The Equity Premium: Why Is It a Puzzle?|url=http://wwwdocs.fce.unsw.edu.au/economics/news/VisitorSeminar/RMehra.pdf|publisher=|work=|accessdate=2009-03-09}} | |||

* {{cite web|author=New Economist(2005)|title=New Economist on Barro and the Equity Premium Puzzle|url=http://economistsview.typepad.com/economistsview/2005/09/new_economist_o.html|publisher=Mehra|work=|accessdate=2009-03-09}} | |||

{{DEFAULTSORT:Rare Disasters}} | |||

[[Category:Economic disasters]] | |||

Revision as of 21:23, 7 March 2013

Template:Economics sidebar A rare disaster is an economic event that is infrequent and large in magnitude, having a negative effect on an economy. Rare disasters are important because they provide an explanation of the equity premium puzzle, the behavior of interest rates, and other economic phenomena.

The parameters for a rare disaster are a substantial drop in GDP and at least a 10% decrease in consumption. Examples include financial disasters: The Great Depression and the Asian Financial Crisis; wars: World War I, World War II and regional conflicts; epidemics: Influenza outbreaks and the Asian Flu; and weather events: Tsunamis and Earthquakes; however, any event that has a substantial impact on GDP and consumption could be considered a rare disaster.

The idea was first proposed by Rietz in 1988, as a way to explain the equity premium puzzle. Since then, other economists have added to and strengthened the idea with evidence, but many economists are still skeptical of the theory.

Model

The model set forth by Barro is based upon the Lucas's fruit tree model of asset pricing with exogenous, stochastic production. The economy is closed, the amount of trees is fixed, output equals consumption ( Buying, selling and renting HDB and personal residential properties in Singapore are simple and transparent transactions. Although you are not required to engage a real property salesperson (generally often known as a "public listed property developers In singapore agent") to complete these property transactions, chances are you'll think about partaking one if you are not accustomed to the processes concerned.

Professional agents are readily available once you need to discover an condominium for hire in singapore In some cases, landlords will take into account you more favourably in case your agent comes to them than for those who tried to method them by yourself. You need to be careful, nevertheless, as you resolve in your agent. Ensure that the agent you are contemplating working with is registered with the IEA – Institute of Estate Brokers. Whereas it might sound a hassle to you, will probably be worth it in the end. The IEA works by an ordinary algorithm and regulations, so you'll protect yourself in opposition to probably going with a rogue agent who prices you more than they should for his or her service in finding you an residence for lease in singapore.

There isn't any deal too small. Property agents who are keen to find time for any deal even if the commission is small are the ones you want on your aspect. Additionally they present humbleness and might relate with the typical Singaporean higher. Relentlessly pursuing any deal, calling prospects even without being prompted. Even if they get rejected a hundred times, they still come again for more. These are the property brokers who will find consumers what they need eventually, and who would be the most successful in what they do. 4. Honesty and Integrity

This feature is suitable for you who need to get the tax deductions out of your PIC scheme to your property agency firm. It's endorsed that you visit the correct site for filling this tax return software. This utility must be submitted at the very least yearly to report your whole tax and tax return that you're going to receive in the current accounting 12 months. There may be an official website for this tax filling procedure. Filling this tax return software shouldn't be a tough thing to do for all business homeowners in Singapore.

A wholly owned subsidiary of SLP Worldwide, SLP Realty houses 900 associates to service SLP's fast rising portfolio of residential tasks. Real estate is a human-centric trade. Apart from offering comprehensive coaching applications for our associates, SLP Realty puts equal emphasis on creating human capabilities and creating sturdy teamwork throughout all ranges of our organisational hierarchy. Worldwide Presence At SLP International, our staff of execs is pushed to make sure our shoppers meet their enterprise and investment targets. Under is an inventory of some notable shoppers from completely different industries and markets, who've entrusted their real estate must the expertise of SLP Worldwide.

If you're looking for a real estate or Singapore property agent online, you merely need to belief your instinct. It is because you don't know which agent is sweet and which agent will not be. Carry out research on a number of brokers by looking out the internet. As soon as if you find yourself certain that a selected agent is dependable and trustworthy, you'll be able to choose to utilize his partnerise find you a house in Singapore. More often than not, a property agent is considered to be good if she or he places the contact data on his web site. This is able to imply that the agent does not thoughts you calling them and asking them any questions regarding properties in Singapore. After chatting with them you too can see them of their office after taking an appointment.

Another method by way of which you could find out whether the agent is sweet is by checking the feedback, of the shoppers, on the website. There are various individuals would publish their comments on the web site of the Singapore property agent. You can take a look at these feedback and the see whether it will be clever to hire that specific Singapore property agent. You may even get in contact with the developer immediately. Many Singapore property brokers know the developers and you may confirm the goodwill of the agent by asking the developer. ) and there is no investment or depreciation. As ( Buying, selling and renting HDB and personal residential properties in Singapore are simple and transparent transactions. Although you are not required to engage a real property salesperson (generally often known as a "public listed property developers In singapore agent") to complete these property transactions, chances are you'll think about partaking one if you are not accustomed to the processes concerned.

Professional agents are readily available once you need to discover an condominium for hire in singapore In some cases, landlords will take into account you more favourably in case your agent comes to them than for those who tried to method them by yourself. You need to be careful, nevertheless, as you resolve in your agent. Ensure that the agent you are contemplating working with is registered with the IEA – Institute of Estate Brokers. Whereas it might sound a hassle to you, will probably be worth it in the end. The IEA works by an ordinary algorithm and regulations, so you'll protect yourself in opposition to probably going with a rogue agent who prices you more than they should for his or her service in finding you an residence for lease in singapore.

There isn't any deal too small. Property agents who are keen to find time for any deal even if the commission is small are the ones you want on your aspect. Additionally they present humbleness and might relate with the typical Singaporean higher. Relentlessly pursuing any deal, calling prospects even without being prompted. Even if they get rejected a hundred times, they still come again for more. These are the property brokers who will find consumers what they need eventually, and who would be the most successful in what they do. 4. Honesty and Integrity

This feature is suitable for you who need to get the tax deductions out of your PIC scheme to your property agency firm. It's endorsed that you visit the correct site for filling this tax return software. This utility must be submitted at the very least yearly to report your whole tax and tax return that you're going to receive in the current accounting 12 months. There may be an official website for this tax filling procedure. Filling this tax return software shouldn't be a tough thing to do for all business homeowners in Singapore.

A wholly owned subsidiary of SLP Worldwide, SLP Realty houses 900 associates to service SLP's fast rising portfolio of residential tasks. Real estate is a human-centric trade. Apart from offering comprehensive coaching applications for our associates, SLP Realty puts equal emphasis on creating human capabilities and creating sturdy teamwork throughout all ranges of our organisational hierarchy. Worldwide Presence At SLP International, our staff of execs is pushed to make sure our shoppers meet their enterprise and investment targets. Under is an inventory of some notable shoppers from completely different industries and markets, who've entrusted their real estate must the expertise of SLP Worldwide.

If you're looking for a real estate or Singapore property agent online, you merely need to belief your instinct. It is because you don't know which agent is sweet and which agent will not be. Carry out research on a number of brokers by looking out the internet. As soon as if you find yourself certain that a selected agent is dependable and trustworthy, you'll be able to choose to utilize his partnerise find you a house in Singapore. More often than not, a property agent is considered to be good if she or he places the contact data on his web site. This is able to imply that the agent does not thoughts you calling them and asking them any questions regarding properties in Singapore. After chatting with them you too can see them of their office after taking an appointment.

Another method by way of which you could find out whether the agent is sweet is by checking the feedback, of the shoppers, on the website. There are various individuals would publish their comments on the web site of the Singapore property agent. You can take a look at these feedback and the see whether it will be clever to hire that specific Singapore property agent. You may even get in contact with the developer immediately. Many Singapore property brokers know the developers and you may confirm the goodwill of the agent by asking the developer. ) is the output of all the trees in the economy and ( ) is the price of the periods fruit (the equity claim). The equation below shows the gross return on the fruit tree in one period.[1]

In order to model rare disasters, Barro introduces the equation below, which is a stochastic process for aggregate output growth. In the model, there are three types of economic shocks:

a.) Normal iid shocks

b.) Type () disasters which involve sharp contractions in output, but no default on debt.

c.) Type () disasters which involve sharp contractions in output and at least a partial default on debt.

The type ω () models low probability disasters and () is a random iid variable. They are assumed to be independent so they are interchangeable in the equation. Then from the above equation, the magnitude of the contraction from () is determined by the following equation.

In this equation, p is the probability per unit of time that a disaster will occur in each period. If the disaster occurs, b is the factor by which consumption will shrink. The model requires a p that is small and a b that large to correctly model rare disasters. In Barro's analysis, d is also used to deal with the problem of the partial default on bonds.

Applications

Since Rietz and Barro, the rare disaster framework can be used to explain many events in finance and economics.

The Equity Premium

Much of the equity premium puzzle can be explained by the rare disaster scenarios proposed by Barro and Rietz. The basic reasoning is that if people are aware that rare disasters (i.e. the Great Depression or World War I and World War II) may occur, but the disaster never occurs during their lives, then the equity premium will appear high.

Barro and subsequent economists have provided historical evidence to support this claim. Using this evidence, Barro shows that rare disasters occur frequently and in large magnitude, in economies around the world from a period from the mid-19th century to the present day.

Further, the evidence shows that in the long run the risk premium is around 5.0% in most countries. However, if when looking at specific periods of time this premium may be higher or lower. For example, if a data set of the period of the Great Depression is observed, then the equity premium will be about 0.4%, because the Great Depression was a rare disaster.[1]

Risk-Free Interest Rate Behavior

The risk-free interest rate (the interest received on fixed income, like bonds) may also be explained by rare disasters. Using data in the United States, the rare disaster model shows that the risk-free rate falls by a large margin (from .127 to .035) when a rare disaster with the probability of .017 is introduced into the data set.[1]

Furthermore, Barro defends the criticisms about the behavior of the risk free rate raised by Mehra with respect to the Great Depression and events such as dropping the Atom Bomb in World War II. He reasons that two effects go into people's expectation of rare disasters-the probability of a rare disaster and the probability of default. In an event that has the possibility of nuclear war (like the Cuban Missile Crisis or World War II), the probability of a disaster would rise and therefore, decrease interest rates. However, the probability of government default on bonds also increases, because of the possible destruction of countries, which raises the rate on bonds. These to forces counteract and lead to ambiguity. As shown left with the risk free rate before and falling after the Great Depression, then falling initially during World War II and then rising afterward.[1]

History

Edward C. Prescott and Rajnish Mehra first proposed the Equity Premium Puzzle in 1985. In 1988, Rietz suggested that large and infrequent economic shocks could explain the equity premium (the premium of securities over fixed income assets). However, it was not deemed feasible at the time, because it seemed that such events were too rare and could not occur in reality.[2] The theory was forgotten until 2005, when Robert Barro provided evidence of nations from around the world from the 19th and 20th century, showing that these events were possible and have happened. Since his papers, others have submitted different ideas regarding rare disasters' impact on other economic phenomenon.[2] However, many economists remain skeptical of how much rare disasters really explain the equity premium and Mehra still expresses doubt as to the validity of the theory.[3]

Controversy

Rajnish Mehra was skeptical of Reitz's claim that rare disasters explain the equity premium and real interest rate behavior, because the rare disaster that Rietz had specified had never occurred in the U.S. Rietz suggested 25-97% drops, but this has never happened in the United States. Even if this were true, there are several other flaws regarding his model, parameters, and supporting evidence. The model Rietz presented did not compensate for a partial default on bond holders do due rapid inflation. Further, the risk aversion in parameter was used inconsistently in his analysis. For example, a value of 10 was used to show a 25% drop in consumption, but a value of 1 is used to explain stock returns and consumption. Finally, more historical evidence was said to have been needed to give the theory proper support. For example, the perceived probability of a rare disaster should have been low before the atomic bomb was dropped and must have been higher before the Cuban Missile Crisis than after. Therefore, real interest rates should have correlated with these events, but they did not. Mehra concluded that Rietz's scenario was far too extreme to resolve the puzzle.[3]

References

Notes

43 year old Petroleum Engineer Harry from Deep River, usually spends time with hobbies and interests like renting movies, property developers in singapore new condominium and vehicle racing. Constantly enjoys going to destinations like Camino Real de Tierra Adentro.

Bibliography

- ↑ 1.0 1.1 1.2 1.3 Template:Cite web

- ↑ 2.0 2.1 pp. 2–3 Cite error: Invalid

<ref>tag; name "Mehra10" defined multiple times with different content - ↑ 3.0 3.1 * Template:Cite web